Fueling Your Business with SBA Financing: A Guide for Small Businesses

The U.S. Small Business Administration (SBA) continues to empower entrepreneurs. In 2024, over 70,000 SBA-guaranteed loans provided vital capital, fueling small business growth and job creation nationwide. This robust support underscores the SBA's critical role in the American economy. With that, understanding the SBA loan process is crucial for small business owners seeking to leverage these resources for growth and success

Why Consider an SBA Loan?

When expanding your business requires funds beyond your immediate reach, SBA loans offer a valuable solution. SBA loans are designed to assist small businesses in various stages of growth, from start-up to expansion, ensuring they have access to the necessary capital. Guaranteed by the government, these loans provide significant flexibility. Although the application process demands more documentation than conventional bank loans, partnering with the right lender can simplify this complexity.

Understanding SBA Loan Benefits

SBA 7(a) loans are versatile, covering start-up costs, operational expenses, debt restructuring, and more. These loans offer terms of up to 25 years, compared to the shorter terms of typical business loans. Additionally, SBA loans cater to most business owners with longer repayment periods and often more favorable interest rates. This flexibility makes SBA loans an attractive option for entrepreneurs looking to invest in their businesses without immediate financial strain.

Key Features and Terms

- Flexible terms– fixed or floating rates

- Smaller down payments

- Lenient collateral requirements

Making Informed Decisions

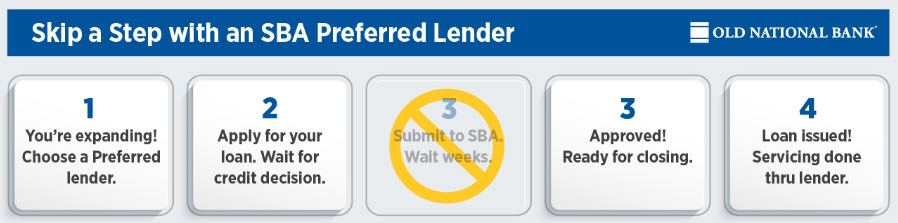

Collaborating with experienced lenders is crucial to help ensure a smoother SBA loan application process. The SBA’s Lender Match program aids in connecting borrowers with experienced lenders, ensuring small business owners can navigate the application process more efficiently. A Preferred Lender can prepare you for a smooth process and quickly spot errors or omissions in your paperwork. Equally important, SBA Preferred Lenders, such as Old National Bank, have SBA approval authority to make final credit decisions at the bank level on SBA 7(a) Loans. This could potentially save weeks in processing time.

Steps to Take Before Applying for an SBA Loan

As a prospective SBA loan borrower, clear communication is key. Be ready to articulate your need for the funds. A comprehensive business plan detailing these specifics is strongly advised. Furthermore, demonstrating your repayment strategy, supported by adequate cash flow, is essential. This includes providing your three most recent business tax returns (not required for start-ups) and personal tax returns from all owners.

Plus, leverage your network. Connect with other business owners and learn from their experiences, asking for SBA lender recommendations. Alternatively, consult trusted advisors like your CPA or attorney for tailored expert advice.

Want to know more about SBA financing? Connect with an Old National Bank today. As an SBA Preferred Lender, we’re happy to talk through your options and help provide a pathway to sustained growth.

All loan programs are subject to credit review and approval. Proof of property insurance required for all loans secured by property. Rates are subject to change daily. Additional rates and fees apply depending on requirements of the program selected. Contact your Old National Business Banker for current rates.