Contact Client Care

We’re here to assist you! Contact us in the way that’s best for you — or search our Frequently Asked Questions (FAQs) to find the answer you need.

We’re here to assist you! Contact us in the way that’s best for you — or search our Frequently Asked Questions (FAQs) to find the answer you need.

Client Care: 1-800-731-2265

Mortgage Servicing: 1-866-853-3277

Wealth Management, including 1834:

1-800-830-0362

Treasury Management: 1-800-844-1720

Monday-Friday

7am to 6pm CT/8am to 7pm ET

Saturday

7am to noon CT/8am to 1pm ET

Sunday

Closed

Frequently Asked Questions (FAQs)

Chances are, if you have a question, so did someone else! Get the answer you need below, sorted by topic.

Account Information | Checking Accounts | Debit Cards | ATMs/Branches | Online & Mobile Banking | Mobile Deposit | Mortgage Loans | Other Loans | Wealth | Credit Cards | Security

A: Within Online Banking, your full account number can be found through the following steps:

A:

Visit any Old National banking center for assistance.

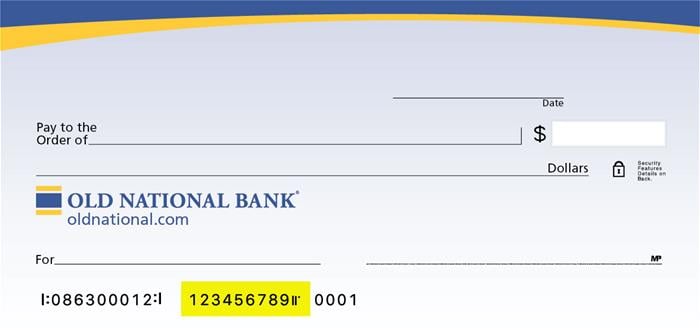

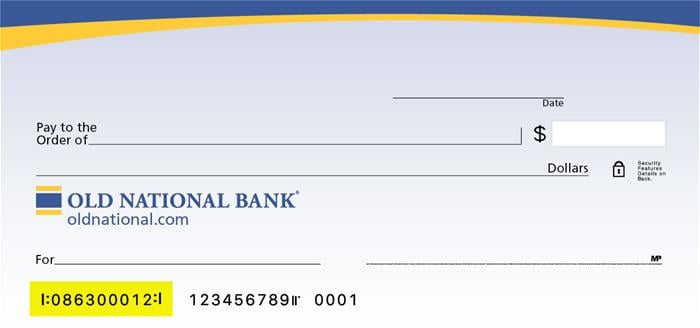

A: The Routing Number for Old National Bank is 086300012, as shown on the sample check below.

A: To change your mailing address, Old National offers several options:

To change your phone number or email address:

Please note that changes can only be applied to the information for the person requesting the change. If there are additional people listed on the account, those individuals will need to request updates for their own information.

When will my deposit be available?

Funds deposited to your account will be available to you, based on several factors we have listed below.

A check written from an account at a bank other than Old National:

Will not be available until the next business day (if it was deposited by the close of business and there are no holds placed on the checks). This means these funds will not be available to cover checks or other debits processed that night. An extended hold also may be needed. You will be notified if an extended hold is placed on the deposit.

A check written from an account at Old National:

Will be added to your account and will have same-day availability (if it was deposited by the close of business). This means these funds will be available to cover checks or other debits processed that night.1

Cash or Direct Deposit (e.g. payroll, Social Security):

Will be available the same day as deposit.1

1 Deposits of this type made at an ATM prior to daily cutoff times are credited to your account and available to cover checks or other debits being processed that night.

A: Your Current Balance shows the amount of money in your account at the end of the previous day (after deposits, withdrawals, and ATM and debit card transactions). This includes only transactions that have cleared.

Your Available Balance is your Current Balance minus any holds, uncollected deposits and transactions received but not yet processed by Old National, which may include certain ATM or debit card transactions. It also does not include checks you have written but have not been presented by the recipients.

Please refer to our Deposit Account Agreement and Disclosure for more information about the timing and order of transactions we use to calculate your account balance at the end of each day.

If you have questions, please call Client Care at 1-800-731-2265 or visit any Old National banking center.

A: To obtain your Old National loan account number, visit any Old National banking center or call Client Care at 1-800-731-2265, Option 4, for assistance.

A: We do provide a way to open most checking accounts online. Go to our Compare Checking Accounts page, find the account that best suits your needs and select the Open Now button.

We offer a variety of checking accounts to meet different needs. If you would like to talk to someone about the type of checking that would be best for you, please visit a banking center or call us at 1-800-731-2265.

A: There are several ways to order checks:

If you are a former First Midwest Bank client, you are welcome to continue using your First Midwest Bank checks until you run out; they will be accepted for at least two years.

A: Please be aware that a stop payment fee of $38 per item applies. You can submit a stop payment request in one of several ways:

A: If there is not enough of an available balance in your account to cover a withdrawal or payment presented against your account, an overdraft will occur and fees may be assessed. These are called NSF fees or overdraft fees. You may also hear the term "insufficient funds" used.

An NSF fee is charged when a checking account is overdrawn causing a negative balance at the end of the previous business day. NSF fees are always charged the day after the overdraft occurs. You can avoid NSF fees by making a deposit to bring your account to a positive balance by the end of the business day.

For specific details regarding an overdraft, or to sign up for overdraft coverage, please visit any Old National banking center or call Client Care at 1-800-731-2265.

A: In an effort to help you avoid returned checks or declined transactions, we provide protection services called Overdraft Courtesy and Overdraft Protection. These two services can also be used together for extra protection. Learn more about our Overdraft Solutions

Overdraft Courtesy

Most Old National checking accounts come with Overdraft Courtesy. With Overdraft Courtesy, even if you don’t have enough available money in your checking account, we may still approve and pay checks you’ve written, as well as ACH and recurring debit card transactions (such as utility bills). Overdraft Courtesy does not cost anything unless you use it. If your account becomes overdrawn by more than $25, we will charge you a $36 fee for each overdraft item, up to 2 per day. You are responsible for paying the amount of any overdraft on your account immediately. If your account is overdrawn 7 or more consecutive business days, we will charge a $7 Daily Overdraft fee each business day the account is overdrawn by more than $25 (beginning on day 7), for up to 5 business days.

Overdraft Protection

Overdraft protection allows you to link your account to another Old National account. If you accidentally overdraft, we will draw the funds from your linked account. There is no annual fee for the Overdraft Protection service, and you can link to other Old National checking, savings, or money market accounts or a line of credit. The transfer amount will be the exact amount needed to cover the total overdraft amount at the end of each business day, provided your linked account has a sufficient available balance. If sufficient funds are not available in your linked account, we will transfer what is available. Any items not covered by the funds in your linked account will be paid or returned at the Bank’s discretion and applicable overdraft and other account fees may be charged.

For business analysis accounts, an Overdraft Protection Transfer Fee of $5 is charged for each transfer from your linked account.

To sign up for Overdraft Protection, or for more information about either service, please visit any Old National banking center or call Client Care at 1-800-731-2265.

A: When you pay with your debit card, you may have a “pre-authorization hold” added to your account before the actual charge goes through. Businesses do this to make sure you have the funds available to cover the purchase, especially when the total amount is unknown at the time you use your card.

For example, when you swipe your card before pumping gas, a pre-authorization hold is put on your account for an amount that’s probably going to be higher than what you’ll actually spend. When you reserve a hotel room, a hold is placed on the account for the cost of the room, plus a little more in case you have additional services during your stay. When you pay for your meal at a restaurant, a hold may be placed for the cost of the meal plus extra for the possible tip. Once the actual amount is known, that number becomes the charge. And once the charge clears your account (typically during the bank’s evening processing), the pre-authorization hold is released.

Pre-authorization holds often can be considerably higher than what you will actually pay, and may stay on your account for a while (days, in some situations) so be sure you are prepared for this amount to be “on hold” in your account in the interim. Remember, you won’t have access to the excess funds until after the actual charge clears and the pre-authorization is released.

Example: Joe visits a gas station and swipes his debit card before pumping his gas. The business doesn’t know how much gas Joe will pump, but it assumes the charge will be $50 or under. They place a pre-authorization hold on Joe’s card for $50 to ensure the funds are available. Joe pumps $20 worth of gas. That means there now is an extra $30 on hold in Joe’s account, and he will not have access to that money until the $20 charge clears and the $50 pre-authorization hold is released.

If you have questions, call Client Care at 1-800-731-2265.

A: Your debit card will continue to work until the last day of its expiration month. You should automatically receive a replacement card around the third week of the month that your card is set to expire.

To protect against potential card theft, your card will arrive in an unmarked, white envelope that does not display the Old National name or logo. Please watch your mail carefully to avoid accidentally discarding it.

If you have not received your new card by the end of the expiration month, please call Client Care at 1-800-731-2265, Option 2, or visit any Old National banking center for assistance.

Please note that if you have not used your card in the past 12 months, or we do not have a correct address on file for you, this may prevent you from automatically receiving a replacement card.

A: Call 1-800-992-3808 and follow the prompts for activating your card and establishing a personal identification number (PIN).

If you have questions or need assistance, call Client Care at 1-800-731-2265.

A: Please call 1-800-992-3808 and follow the prompts for setting up a new Personal Identification Number (PIN).

If you have trouble with the automated system, please call Client Care at 1-800-731-2265, Option 2, for assistance.

A: If you notice unauthorized debit card activity on your statement or through Online and Mobile Banking, you can turn your debit card off right away using our Card Controls. Card Controls is a feature you can access at any time in Digital Banking including within the ONB Mobile App.

You should also contact us at 1-800-731-2265 to report the unauthorized activity on your debit card. We can then cancel or restrict your card, check for other unauthorized transactions and order a new card for you.

If your debit card has been lost or stolen, you can report it 24-hours a day by calling 1-800-731-2265, option 2, in the US. If you are outside of the US, call 1-812-422-2197.

A: You can report your lost or stolen Old National debit card 24-hours a day by calling 1-800-731-2265, option 2, in the US. If you are outside of the US, call 1-812-422-2197. We can cancel or restrict your debit card, check for unauthorized transactions and order a new debit card for you.

If you notice unauthorized activity on your debit card through Digital Banking, you can turn your card off right away with the Card Controls feature in Online Banking and the Mobile App.

Even if you use Card Controls to turn off your debit card, you should still contact us at 1-800-731-2265 to report the unauthorized activity on your card and obtain a new one.

A: To order a replacement for a damaged debit card, call Client Care at 1-800-731-2265 or visit any banking center.

The normal timeframe for delivery is 7-10 business days. To receive a card sooner, you can instead choose to pay a $35 fee and receive the replacement card in two business days. The card must be ordered by 4pm on any business day in order for it to be delivered in two business days.

A Lost or Stolen Debit Card

If instead of a damaged debit card you need help with a lost or stolen card, please call us at 1-800-731-2265, option 2, in the US. You can report a lost or stolen card 24-hours a day. If you are outside of the US, call 1-812-422-2197. We can cancel or restrict your card, check for unauthorized transactions and order a new card for you.

A: Yes, if you will be using your debit card in areas where you do not typically travel, you should call Old National Client Care at 1-800-731-2265 or visit any Old National banking center to notify us of your travels before you leave. This will prevent your card from being blocked as a precaution due to unusual activity.

Mastercard® continues to monitor your debit card for suspicious or fraudulent activity while you are traveling. They may attempt to contact you to verify activity on the card, so be prepared to respond to such a call.

It is also a good idea to take phone numbers with you in case you need to report a lost or stolen debit card. You can report a lost or stolen card 24-hours a day by calling 1-800-731-2265 in the US or 1-812-422-2197 from outside of the US.

If you have questions about using your debit card while traveling, please contact Client Care at 1-800-731-2265.

A: Card Controls and Alerts enable you to monitor and manage your debit card activity from within Digital Banking and the ONB Mobile App. There is no cost to use Card Controls.

Here are a few of the benefits of using Card Controls:

Monitor

Know exactly what is happening with your debit card, anytime and anywhere. Turn on alerts for Internet purchases, ATM transactions and more.

Manage

Use Card Controls to immediately turn your debit card on or off in case it is misplaced or lost, or for any other reason. You can also set transaction limits, so all debit card transactions above a certain amount will be declined.

Visit our Card Controls page for more information, including how to enroll.

Even if you use Card Controls to turn off your debit card, you should still contact us at 1-800-731-2265 to report any unauthorized activity.

Please note that Card Controls are for debit card transactions and HELOC cards only. They are not available for checks clearing or ACH transactions.

A: Card Controls and Alerts are a feature of Digital Banking and the ONB Mobile App. You can activate Card Controls within Online Banking and the ONB Mobile App; there is no need for any separate enrollment or downloading of any additional apps.

Card Controls enable you to manage and monitor debit card activity, such as setting and receiving alerts or suspending certain transactions.

A: There are several ways to find an Old National banking center or ATM through our website and our Mobile App:

On the website

Visit Hours and Locations to go to our Branch & ATM locator page. Enter the following information into the Search box.

In the ONB Mobile App

Results of Location searches will be more accurate if you have enabled your mobile device to show your current location.

A: Old National has many ATMs that will accept deposits, and we continue to add more. To find an ATM click here.

You can securely make a deposit at these machines. ATMs that are Cash & Check Deposit do not require an envelope to do so. (Please note that ATMs labeled Cash Only, as well as partner ATMs on the Allpoint® network, do not accept deposits.)

Deposits made at an ATM are available for withdrawal based upon our typical funds availability policy. This means they may not be available for immediate withdrawal and use.

If you have questions about making deposits at an ATM, please contact Client Care at 1-800-731-2265.

A: With your Old National debit/ATM card, you can use any Old National or Allpoint ATM with no fees. (Please be aware that Old National charges a $3.00 fee when you use a non-ONB or non-Allpoint ATM.)

You can find Old National and Allpoint ATMs near you by using the locator on oldnational.com. You can also use the locator within our Mobile App to find your nearest ATMs.

The Allpoint ATM network provides 55,000 surcharge-free ATMs located in local, regional and national retailers across all 50 states, Puerto Rico, Canada, Mexico, Australia and the United Kingdom. This includes merchants such as CVS, Kroger, Target, Walgreens, Winn-Dixie and many others.

A: Allpoint is a network of 55,000 ATMs that provides Old National clients fee-free (also known as surcharge-free) access to their accounts.

Allpoint ATMS are located in local, regional and national retailers across all 50 states, Puerto Rico, Canada, Mexico, Australia and the United Kingdom. This includes merchants such as CVS, Kroger, Target, Walgreens, Winn-Dixie and many others.

Transactions that can be completed at Allpoint ATMs include withdrawals, transfers and balance inquiries. HSA and home equity cards cannot be used at Allpoint ATMs.

Allpoint ATMs will also have an Allpoint logo on them. Some may also be branded by other financial institutions, but you can still use them fee-free if they have the Allpoint logo showing they are part of the Allpoint Network.

A: To find an Allpoint ATM, go to our website locator and select "Allpoint Surcharge-Free ATM".

Allpoint ATMs are located in local, regional and national retailers across all 50 states, Puerto Rico, Canada, Mexico, Australia and the United Kingdom. This includes merchants such as CVS, Kroger, Target, Walgreens, Winn-Dixie and many others.

Allpoint is a network of 55,000 ATMs that provides Old National clients fee-free ATM access to their accounts.

Digital Banking (Online & Mobile Banking)

A: In a Banking Center

Associates in our banking centers can enroll you in Digital Banking with immediate access, whether you already have an Old National account or open one that same day. You can then access your Digital Banking account via a web browser, your smartphone, or you can download our Mobile App for the best banking experience on your phone.

Opening a Checking Account Online

If you open a new Old National account online, you can enroll in digital banking immediately.

Steps for Online Enrollment of Digital Banking

There are several options for enrolling online:

Once on the enrollment page:

select the box and click Complete Sign Up.

If the information matches, then you will be directed to the login. If the information does not match, you will receive a Pending or Declined message. For Pending applications, you should receive an email within 1 business day advising the status of your registration.

If you’re a business client, please visit a banking center or call 1-800-731-2265 for assistance with enrollment.

Why is my request for Digital Banking access showing as declined or pending?

When you complete the Digital Banking enrollment process, we must verify the information you provide in order to prevent any unauthorized access to your account. The security of client information is one of our highest priorities. If your request for Digital Banking has been declined, it most likely means we were not able to successfully verify the information you provided during the enrollment process. A pending status most likely means we are working to verify your information. We will email you to notify you when your Digital Banking enrollment request is approved or declined.

If you have questions or concerns about your Digital Banking enrollment, please call Client Care at 1-800-731-2265, and one of our associates would be happy to assist you.

When you complete the Digital Banking enrollment process, we must verify the information you provide in order to prevent any unauthorized access to your account. The security of client information is one of our highest priorities. If your request for Digital Banking has been declined, it most likely means we were not able to successfully verify the information you provided during the enrollment process. A pending status most likely means we are working to verify your information. We will email you to notify you when your Digital Banking enrollment request is approved or declined.

If you have questions or concerns about your Digital Banking enrollment, please call Client Care at 1-800-731-2265, and one of our associates would be happy to assist you.

A: To find and download the ONB Mobile App, just follow these steps.

You can also follow our brief tutorials:

For the App Store:

For Google Play:

Learn more about the ONB Mobile Banking App.

With the ONB Mobile App, you can do the following and more:

There is no charge for use of the ONB Mobile App.

If you need assistance with downloading the ONB Mobile App, please call Client Care at 1-800-731-2265.

A: eStatements are online, electronic copies of your account statements that you can quickly view, search, save and print. You can view them on your computer and your mobile device.

Signing up for eStatements

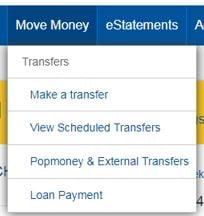

To enroll in eStatements through Online Banking or the Mobile App, just follow these simple steps:

On a web browser

On the ONB Mobile App

Enrolling in eStatements from the ONB Mobile App is similar. Watch our tutorial on signing up for eStatements from your phone.

Up to 18 months of eStatements may be immediately available upon enrollment. Note that enabling eStatements will stop the delivery of a paper statement to your mailing address.

Viewing eStatements

On a web browser

Note: Another way to search for a specific eStatement is to use the Document Search option at the top of the eStatements page.

In the ONB Mobile app

If you need assistance with signing up for eStatements or using them, please contact Client Care at 1-800-731-2265.

You can also visit the eStatements page on our website.

A: Once a check has cleared on your Old National checking account, you will automatically have an image of it within your Digital Banking transaction history.

On a web browser

Once you have located the check image you are searching for, you can select it to open an image of the front and back of the check. Above the check, to the right, is a printer icon you can use to print a copy of the check.

ONB Mobile app

If you have trouble locating your check image within Digital Banking, please contact Client Care at 1-800-731-2265.

A: Bill Pay is a free service that enables you to pay your credit card bill, cell phone bill, mortgage payment, utilities, individuals or really any bill you want to pay. Payment is taken directly from your Old National account. It's easy to begin using Online Bill Pay:

From a web browser

Within Digital Banking, you can make one-time payments and set up automated, repeat payments. You can also enroll to receive eBills (electronic bills) from payees with Bill Pay and view your eBills history. Please note: Depending on the party you are paying, payments may be sent electronically or a physical check will be produced and mailed.

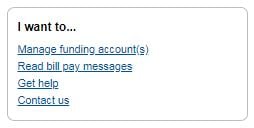

Our Bill Pay has its own FAQ as well. You can find it on the Bill Pay screen in the lower right corner under I want to. . .

In the ONB Mobile app

If you need assistance with enrolling in Bill Pay, please contact Client Care at 1-800-731-2265.

A: If our Digital Banking does not recognize the device you are using to log in, you are asked to verify your identity for the security of your account. There are several common reasons that this happens such as:

After you complete the verification steps of receiving a code by phone call, text message or email, and you enter it to confirm your identity, you can choose Yes, register my private device to avoid repeating the verification process each time.

If you have questions about verification, please call Old National Client Care at 1-800-731-2265.

A: To protect your account against unauthorized access, you may be "locked out" if you have attempted to log in to Digital Banking using incorrect login credentials (user name and password) multiple times. The length of time that you are locked out will depend on how many times you have attempted to log in using incorrect credentials. Here is how to regain access to your account:

Resetting your credentials

Most lock-out periods are brief, and after that time period has ended, you can reset your own login credentials in Digital Banking by doing the following:

From a web browser

From a web browser such as Chrome, Firefox or Safari, go to the oldnational.com. Go to the blue Login box on the upper right side of the page. Click on Forgot User ID or Password. You will be asked to provide information to retrieve or reset your login credentials.

In the ONB Mobile App

If you are using the ONB Mobile App, on the Login screen, select Forgot Login. Enter the requested information to retrieve or reset your login credentials.

Please note, that when requesting or resetting your User ID or Password, you will be asked to enter your email or phone number. For security purposes, the email or phone number you enter must match the email or phone number you have provided for your account.

Contacting Client Care

If, after trying the above, you are not able to retrieve or reset your password, or you are not able to wait for the lock-out period to expire, please call Client Care at 1-800-731-2265, Option 3, for login assistance.

What should I do if I forgot my User ID or Password for Digital Banking?

Your user ID and Password for Digital Banking and the ONB Mobile app are the same. If you have forgotten your User ID and Password, you can do one of the following:

Please note, when requesting or resetting your User ID or Password, you will be asked to enter your email or phone number. For security purposes, the email or phone number must match the email or phone number you have provided for your account. Additionally, resetting your User ID or Password disables your biometrics. To enable, within your app navigate to "More" and access your settings.

A: Your user ID and Password for Digital Banking and the ONB Mobile app are the same. If you have forgotten your User ID and Password, you can do one of the following:

Please note, when requesting or resetting your User ID or Password, you will be asked to enter your email or phone number. For security purposes, the email or phone number must match the email or phone number you have provided for your account. Additionally, resetting your User ID or Password disables your biometrics. To enable, within your app navigate to "More" and access your settings.

A: We are pleased to be able to offer you the ability to send money in minutes with Zelle®. With this level of convenience, we take the safeguarding of your accounts and identity seriously. Because of that, you many encounter situations when your Zelle® account and transactions may be put on hold until your identity can be further verified. Having a transaction put on hold should become less likely as you build your positive transaction history with Zelle®.

A: If you’re a small business client, associates in our banking centers can enroll you in Small Business Digital Banking. Once enrolled, you can then access your Small Business Digital Banking account via web browser or download our mobile app for the best experience.

A: Mobile Deposit is a feature within Digital Banking that allows you to deposit checks by using your phone's camera.

To use Mobile Deposit

You will receive an email confirmation once a Mobile Deposit has been submitted. A second email will be generated when the deposit has been reviewed to let you know the status of the deposit. An approval email does not guarantee that the funds are available immediately. If we receive your mobile deposit by our Mobile Deposit cut-off time of 8pm CST, Monday through Friday (excluding holidays), we consider that business day to be the day of your deposit. Otherwise, we will consider that the deposit was made on the next business day we are open.

Tips for using Mobile Deposit

If you need assistance with using Mobile Deposit, please call Client Care at 1-800-731-2265.

A: You can use Mobile Deposit to deposit checks that are payable to you. You cannot use Mobile deposit for the following:

If you have questions about checks or items that are accepted through Mobile Deposit, please contact Client Care at 1-800-731-2265.

A: Within the endorsement area on the back of the check, sign your name and print "For Mobile Deposit Only."

To learn more about Mobile Deposit, visit our Mobile Deposit page.

If you need assistance with using Mobile Deposit, please call Client Care at 1-800-731-2265.

A: Checks deposited using Mobile Deposit are available for withdrawal based upon our typical funds availability policy. If we receive your mobile deposit by our Mobile Deposit cut-off time of 8pm CST, Monday through Friday (excluding holidays), we consider that business day to be the day of your deposit. Otherwise, we will consider that the deposit was made on the next business day we are open.

Checks written from an Old National account:

If you submit a check written from an Old National account through Mobile Deposit by the 8pm cut-off time, Monday through Friday (excluding holidays), the deposit will be available the same day. In other words, it will be credited to your account and available to cover checks or other debits being processed that night.

Checks written from an account at a bank other than Old National:

If made by the 8pm CST Mobile Deposit cut-off time, Monday through Friday (excluding holidays), these deposits will typically be available the next business day. This means these funds will not be available to cover checks or other debits processed that night. In some cases, an extended hold may need to be placed on a mobile deposit, meaning funds will not be available the next business day.

Viewing your mobile deposit

You should be able to view your mobile deposit in your Digital Banking transaction history within one to two business days of your deposit.

If you have questions about your Mobile Deposit, please call Client Care at 1-800-731-2265, or take the check into an Old National banking center.

ATM Deposits

As an alternative to Mobile Deposit, many of our ATMs also accept deposits. When viewing our Branch and ATM locator, use the Advanced Filters to find ATMS that accept cash and/or check deposits.

A: Yes, there is a $5,000 daily limit and a $10,000 monthly limit for mobile deposits made through the ONB Mobile App.

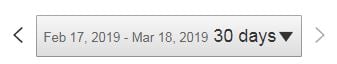

The monthly limit amount is on a rolling 30-day cycle. As mobile deposits become available to you, they will no longer count toward the limit, making room for future deposits.

If you have questions about Mobile Deposit limits, please contact Client Care at 1-800-731-2265.

A: ONB Mortgage Manager enables you to access and manage your Old National mortgage loan through Online and Mobile Banking. For example, you can securely do the following:

ONB Mortgage Manager is a free service for Old National clients.

Visit our ONB Mortgage Manager page to learn more and find guides for using this service.

A: ONB Mortgage Manager is a free service for Old National Mortgage clients. All you have to do is have Digital Banking.

If you don't currently have Digital Banking visit our page on getting started with Digital Banking.

Please note that you will need your Mortgage Loan Account Number to get started in ONB Mortgage Manager.

Visit our ONB Mortgage Manager page to learn more and find guides for using ONB Mortgage Manager.

A: Yes. You can enroll in electronic statements for your Old National mortgage loan within ONB Mortgage Manager. Just follow these steps:

Log into ONB Mortgage Manager Select Account Management Click on Document Center Under Mortgage eStatements select Paperless Statements Open and review eStatement Delivery Terms and Conditions Select I agree to the terms and conditions Click Let's do this!

Use our guide How to Sign Up for Mortgage eStatements for step-by-step instructions as well.

You will receive an email notification letting you know when your statement will be ready for viewing. If you change your mind and would like to resume receiving paper statements in the mail, you can de-activate this service in ONB Mortgage Manager at any time.

A: We have several guides to walk you through step-by-step.

You will find additional information on the ONB Mortgage Manager page.

If you have questions or need additional assistance, you can contact Mortgage Servicing at 1-866-853-3277 or visit any Old National banking center.

A: Use ONB Mortgage Manager within Online and Mobile Banking to make a payment. Our guide for Accessing Mortgage Manager through Online and Mobile can help you get started. Once you have accessed ONB Mortgage Manager, there are several ways to make payments explained in the following guides:

Here are several other options for making mortgage payments:

If you need assistance with any of the above payment options, please contact Mortgage Servicing at 866-853-3277.

A: Yes, mortgage payments can be automatically drafted by signing up for our Autopay service or Flexible Payments (Biweekly Drafting) service within ONB Mortgage Manager.

With Autopay, your mortgage payment draft will occur on the specified date each month or the next business day if the specified day is a non-business day.

With Flexible Payments, a borrower is allowed to make half-payments every two weeks and apply these payments as a full monthly payment once a month.

The following information will help you in setting up automatic payments:

While ONB Mortgage Manager is the simplest way to set up automatic payments, you can also download and return the form. This form can be returned to a banking center, mailed to PO Box 3789, Evansville, IN 47736 or emailed to mortops@oldnational.com to set up automatic payments.

If you need assistance setting up an automatic loan payment or want us to mail an auto pay form to you, please contact Mortgage Servicing at 1-866-853-3277 or visit any Old National banking center.

A: If you submit your payment through ONB Mortgage Manager prior to 9PM CT, it will be posted to your account on the same day.

Where can I find my mortgage loan in the ONB Mobile App?

Once you are logged in to the ONB Mobile App, tap Payment Center. Select Pay Mortgage. Your summary will appear. Select your Mortgage Loan.

View our How to Access Online & Mobile guide.

A: For all personal loans, such as auto loans:

If you need assistance setting up an automatic loan payment or want us to mail an auto pay form to you, please contact Client Care at 1-800-731-2265 or visit any Old National banking center.

A: For personal loan payments (not including mortgage loans), we offer several options:

A: Yes, we provide options to pay on your Old National loan from a checking account outside of Old National.

For auto loan and other consumer loan payments:

You will be taken to a screen where you can input information for the external account you want to take your payment from. Please note that the account at another financial institution will need to be verified, so you may not be able to make your payment immediately.

A: We are not able to stop a single payment, but we can cancel the entire automatic payment service at your request. You can re-establish automatic payments when you are ready.

Requests should be received at least 5 business days prior to the payment due date.

For all personal loans:

Requests to cancel automatic payments can be submitted by completing our Consumer Loan Auto Pay form and either returning it to a banking center or mailing it to PO Box 3728, Evansville, IN 47736.

Please note that late payment fees may apply if we do not receive your loan payment by the due date.

If you have questions or need assistance, please call Client Care at 1-800-731-2265.

A: For the correct amount to pay off a loan, please call Client Care at 1-800-731-2265, Option 4, or visit any Old National banking center.

A loan's payoff information is not available within Online or Mobile Banking. The remaining balance shown on a loan within Online and Mobile Banking may not reflect all interest, fees, payments, etc. To obtain the correct amount to pay off a loan, it is best to call us or visit a banking center.

Please note that loan payoff amounts over $3,500 must be paid in a banking center and cannot be accepted over the phone.

Amounts under $3,500 can be accepted by phone as an electronic check (eCheck) only, and not by credit card or debit card. There is also a fee associated with loan payments made by phone. You will need to have your routing number and account number to pay by eCheck.

Please see our separate FAQ on obtaining the payoff amount for a mortgage loan.

A: Following are some options for obtaining your loan number:

A: Visit our wealth management account access page to find the login portal for your account.

A: Visit our wealth management homepage. Select the service model you’re interested in and click the related “Find an Advisor” link at the bottom of the descriptive tablet.

A: Our wealth management homepage provides descriptions of our wealth management service models. If you want more detail, our advisors are always happy to talk, with no financial obligation. You can search for advisors by service model on the wealth management homepage.

A: Absolutely. Explore the Old National wealth management service models on our wealth management homepage. Once you determine the best approach for you, connect directly with a preferred advisor in your area.

A: There is no specific dollar amount required. At Old National, we believe it’s never too early to start investing. Our Investment Strategies Team (IST) can guide you. In fact, when you’re ready, you can connect with our IST directly, with absolutely no financial obligation for getting financial advice.

A: You can make a payment on your Old National Credit Card online, by mail or over the phone.

Pay online

Please access the Online Account Center for credit cards. You will first need to enroll.

With online account access for your credit card, you can also do the following:

By phone

To make a Credit Card payment by phone, please call Credit Card Customer Service at 1-888-295-5540.

By mail

Credit card payments can be sent to:

Bankcard Payment Processing PO Box 2557 Omaha, NE 68103-2557

A: You can apply for an Old National Credit Card either online or in a banking center.

To apply online, visit our Credit Card page to read about the types of cards we offer. Then select Apply Now next to the card that fits your needs.

All of our credit cards offer the following:

A: If you see an unfamiliar charge on your credit card, and you want to obtain more detailed information, please call 1-888-295-5540.

If you believe your credit card may have been compromised, or you need to report it as lost or stolen, please call 1-800-444-6938.

A: If you believe your credit card may have been compromised, or you need to report it as lost or stolen, please call 1-800-444-6938.

A: For general questions about your credit card, please call Credit Card Customer Service at 1-888-295-5540.

If your card has been lost or stolen, you should call 1-800-444-6938 to report it.

A: If you think you are the victim of identity theft, please call Old National Client Care at 1-800-731-2265 Monday-Friday, 7am to 6pm or Saturday, 7am to noon CT. Using your personal information, a fraudster can commit a wide range of fraudulent activity in your name, so it is important to take security measures.

You can also download our What You Should Know About Identity Theft guide.

A: What you need to know:

If you receive an unexpected phone call that appears to be from Old National seeking personal information, follow these steps:

What you need to do:

If you inadvertently provided personal information and feel your Old National accounts may be in jeopardy, please contact Client Care at 1-800-731-2265 Monday-Friday, 7am to 6pm or Saturday, 7am to noon CT.

A: Please contact us as soon as possible by calling Client Care at 1-800-731-2265, Option 3, to report any suspicious activity on your account.

If you believe someone has gained unauthorized access to your Digital Banking or ONB Mobile app, you should change your Digital Banking credentials. From the web browser, log in to Digital Banking. Go to My Settings in the upper right. Under Log In & Security, edit your User ID and Password. From the Mobile app, Go to My Settings in the upper right. Tap my settings, edit your User ID and Password.

If you believe the unauthorized activity may be a result of someone using your debit card, you can turn your card off (and back on again) with our Card Controls feature in Online Banking and the ONB Mobile App.

Of course, prevention is the best approach. To find information on steps you can take to protect against having your account or information compromised, visit our fraud prevention page.

A: If you inadvertently provided personal information and feel your Old National accounts may be in jeopardy, please contact Client Care at 1-800-731-2265 Monday-Friday, 7am to 6pm or Saturday, 7am to noon CT.

Although fraudsters use various tactics in their attempts to deceive, there are common elements you can look for:

You are your first line of defense:

This is a link to a third-party site. Note that the third party's privacy policy and security practices may differ from the standards of Old National Bank. Complete details regarding third-party links are available in our Terms of Use.

Residents of California have certain rights regarding the sale of personal information to third parties. Old National Bank, our affiliates, and service providers use information collected through cookies or in forms to improve the experience on our site and pages, to analyze how our site is used, and to present personalized advertising.

At any point, you can opt-out of the sale of your personal information by selecting Do Not Sell My Personal Information.

You can find more information and how to manage your privacy choices by reviewing our California Consumer Privacy Disclosures located on our Privacy information page by following the link on the bottom of any page.